Bitcoin (BTC) strengthened near $34,000 after opening on Wall Street on October 24 as the dust settled on 15% of the day’s gains.

Opinions on Bitcoin funding rates vary

Data from Cointelegraph Markets Pro and TradingView have tracked BTC price volatility throughout the day, with the focus at $34,000 at the time of writing.

The pair earlier hit 17-month highs near $35,200 amid new excitement surrounding the potential approval of a Bitcoin spot price exchange-traded fund (ETF) in the United States.

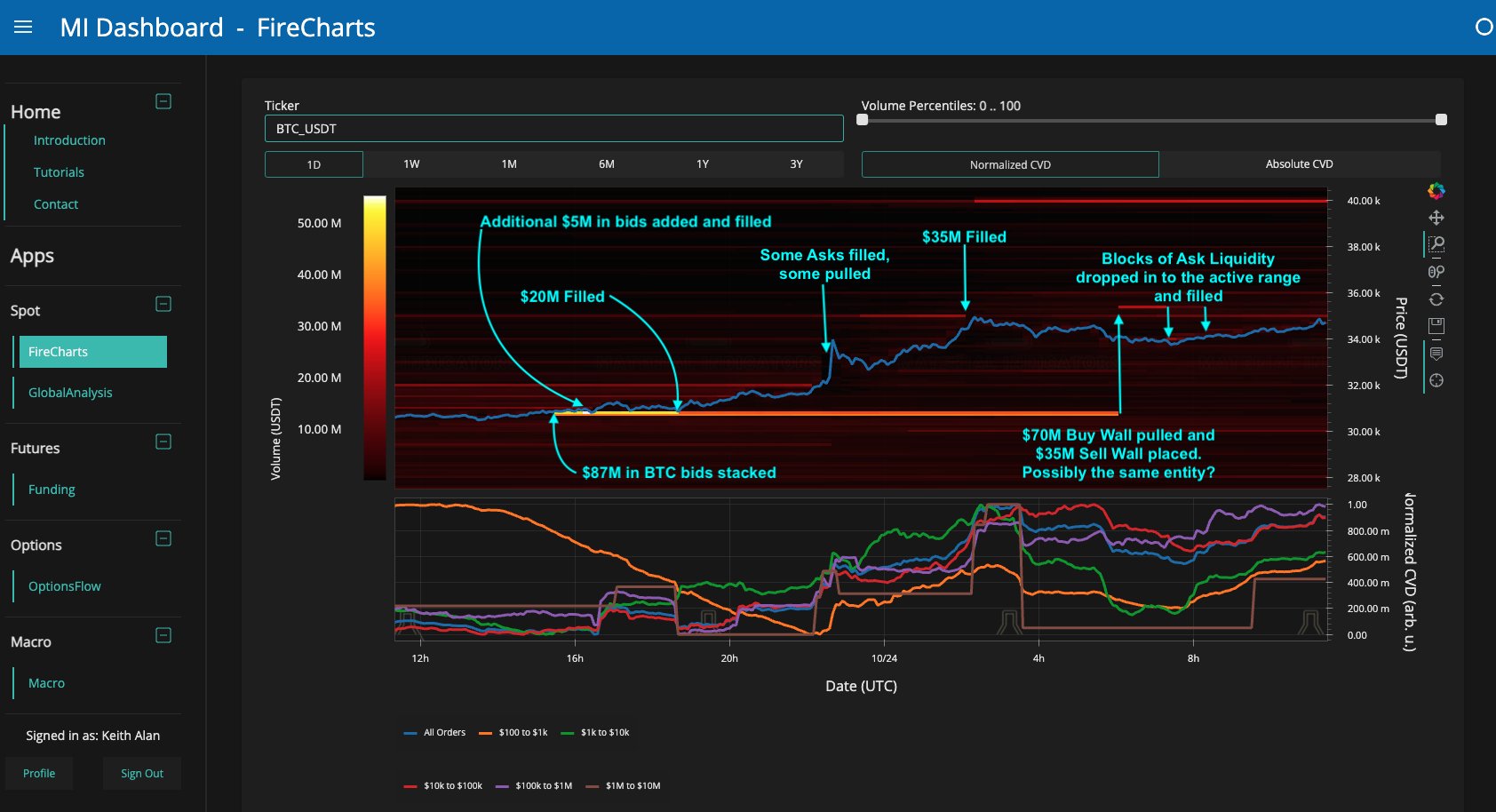

Analyzing the sequence of events that led to the $5,000 daily candle, monitoring resource material indicators revealed a support/resistance (R/S) change at $30,600.

The speed with which the market broke through the resistance that had been in place for the last year and a half was surprising, post X To read. Material Indicators honestly expected greater resistance at 30.5 thousand. dollars, 31.5 thousand dollars and even 33 thousand dollars.

These levels were destroyed, and when the $87 million buy wall appeared at $30.6K. dollars, which without hesitation laid the foundations for a change in the direction of R/S – he explained.

After paying PLN 32,000 dollars, part of the overall liquidity was withdrawn, and the small liquidity made it easier for BTC to quickly reach the level of 35,000. dollars.

The post added that after some liquidity in the offers was withdrawn from below, there was a chance for a potential rebound.

One of the two accompanying charts covered the last 24 hours of the Binance order book.

Other factors that contributed to deeper consolidation included stock market funding rates, which were deep in positive territory at the time of writing.

Be careful with new debts pic.twitter.com/jsuXPdIhRq

CryptoBullet (@CryptoBullet1) October 24, 2023

The funding is blatantly positive, wrote popular CryptoBullet trader during a discussion on X.

This means that the vast majority of traders miss out. The majority is never right. The market maker will need to eliminate these late long positions.

The number of BTC short liquidations on the way up was $161 million and $48 million on October 23 and 24, respectively, according to data from monitoring resource CoinGlass.

Commenting on funding rates, fellow trader Daan Crypto Trades argued that the market may yet maintain its direction, part of familiar bullish behavior.

#Bitcoin It’s still a perpetual bonus, but it’s gone down a bit.

It is worth noting that during bull markets we often had weeks of positive funding rates because it was seen simply as “the price to pay for participation.”

Similarly, we were mostly negative in 2022-2023. https://t.co/W3AtaydaQd pic.twitter.com/Hl2mnVz9sa

Daan Crypto Trades (@DaanCrypto) October 24, 2023

Bitcoin’s retracement on this day resulted in a reversal of the U.S. dollar’s strength that had weakened the day before.

Dollar rebounds as BTC price consolidates

Related:Bitcoin Price Rise Sends BTC-Related Stocks to New Multi-Week Highs

The US Dollar Index (DXY) rose to 106, up 0.5% from the intraday low.

Bitcoin continues to show mixed reactions to DXY moves, where a clear inverse correlation was once evident.

It’s too obvious $DXY moves down as it creates a new low.

At the same time, you can see a nice breakout #Bitcoin. pic.twitter.com/NP65yDnlRJTrader Tardigrades (@TATrader_Alan) October 24, 2023

IN recent commentpopular macro analyst James Stanley argued that the release of personal consumption expenditure (PCE) data on October 26 would be a major determining factor for DXY in the short term.

As Cointelegraph reported, this comes ahead of the Federal Open Market Committee (FOMC) meeting on November 1, where the Federal Reserve will decide on interest rate policy.

The 104.70 level is the lowest level since the last FOMC meeting, even though it is what the bulls need to defend themselves, Stanley wrote.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

#BTC #price #drop #dollars #Bitcoin #Funding #Rates #Egregiously #Positive

Image Source : cointelegraph.com